How To Avoid Account Takeover Fraud

What Is An "Account Takeover?"

| An account takeover happens when a fraudster poses as a financial institution to get your personal or account information. Once the fraudster has access to your account, they can make unauthorized transactions. |  |

How Does It Work?

|

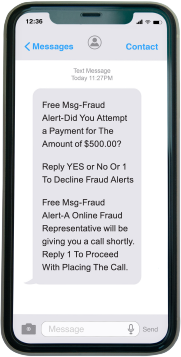

An account takeover begins with a fraudster sending a text message to your mobile phone. They usually claim they‘re from a financial institution‘s fraud department. They ask you to confirm a suspicious payment that was sent from your account — this may not be true and could be part of the fraud. If this is a fraud attack, the fraudster typically follows up with a phone call and asks for your personal information to “cancel the payment.” NOTE: will NEVER ask for your personal information over the phone. The account takeover fraud usually begins on a Friday, after business hours, and runs through the weekend. The phone shows an example of a fraudulent “account takeover” text message. |

How Can You Prevent Account Takeover Fraud?

|

If someone posing as contacts you by phone, email, or text message and wants you to share your personal information, consider it fraud. |

| If you receive a text (or email) like the one shown here, do not reply to the sender. Ignore the message and do not call any phone numbers listed in the text. | |

| If you receive a phone call that seems to be a phishing attempt, end the call immediately. And be aware that area codes can be misleading: a local area code does not always guarantee that the caller is local. |

Avoid Fraud: Do not share your personal information with anyone posing as our institution.