Insurance

Thinking about life insurance can be tough but it's an important step in making sure that you and your loved ones are protected. Insurance investment products are meant to replace the loss of income in the event of a death.

Life Insurance Options

Your life insurance needs will depend on a number of factors, including whether you're married, the size of your family, the nature of your financial obligations, your career stage, and your goals. There are two basic types of life insurance:

- Term Life - life insurance protection for a specific period of time, typically making it the most affordable option. Benefits would be paid to the beneficiaries if you pass within the term of your policy agreement. These are usually available in increments of 10, 20 and 30 years and have no cash value.

- Permanent Life - also called whole life, this insurance protects you for the duration of your life, provided you pay the premium to keep your policy in place.

Long term care and disability insurance are additional options for protecting your assets against short and long term illnesses or injuries.

Our team of Financial Advisors will work together to determine the best option for your situation.

Investment and insurance products and services are offered through INFINEX INVESTMENTS, INC. Member FINRA/SIPC.

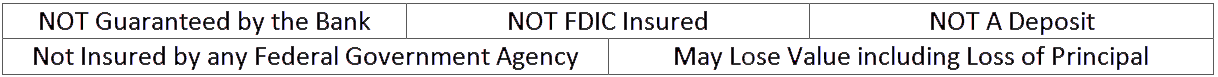

Infinex and Nation Choice Reserve Bank are not affiliated. Products and services made available through Infinex are not insured by the FDIC or any other agency of the United States and are not deposits or obligations of nor guaranteed or insured by any bank or bank affiliate. These products are subject to investment risk, including the possible loss of value.