Savings Plans for College Education

Paying for college can be overwhelming when saving for college hasn't been on your mind. Yet educational expenses are often the second largest family expense - second only to buying a home. And considering how thoughtfully you approached buying a home, it's just as important to find the best education savings plan or fund, no matter the age of your future collegiate.

529 Plans

- Tax-free earnings growth on your earnings while they are in your account

- No income or age limits, giving you flexibility for non-traditional students

- Assets within a 529 college savings plan can be used to pay for qualified expenses at any accredited institution of higher education in the country and some foreign institutions, including colleges, universities, graduate schools and most community colleges and vocational-technical schools.

- Limited use for K-12 education

Coverdell Education Savings Accounts (CESA)

- CESAs are similar to 529 plans in that they are tax-free but only $2,000 a year can be added. You can also use the funds in a CESA for some K-12 education expenses

- Coverdell Education Savings Accounts can be opened on behalf of someone - perhaps your child, grandchild, or niece. Anyone can make a contribution to the account up to the yearly maximum

- The beneficiary of the account can use the money to pay for qualified educational expenses like tuition and books

Custodial Accounts (UTMA)

- UTMA accounts are meant to hold and protect assets for minors, making them a good college savings account

- The custodian is responsible for managing and distributing the money on behalf of the minor until the minor reaches the age required by state law

The key to funding higher education is to start saving early and regularly. Get in touch with your local Financial Advisor to begin the process of building your college savings fund.

Investment and insurance products and services are offered through INFINEX INVESTMENTS, INC. Member FINRA/SIPC.

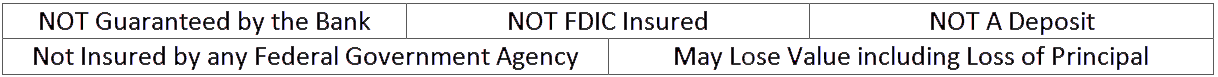

Infinex and Nation Choice Reserve Bank are not affiliated. Products and services made available through Infinex are not insured by the FDIC or any other agency of the United States and are not deposits or obligations of nor guaranteed or insured by any bank or bank affiliate. These products are subject to investment risk, including the possible loss of value.