Retirement Planning Services & Investments

How confident are you in your retirement strategy?

No matter your retirement journey, it's a journey we can take together. Our retirement planning services begin with defining your goals and setting a course of retirement savings and investments that will allow you to reach those goals. We can help.

Retirement Solutions: How Much Should I Save for Retirement

Your 20s, 30s, and 40s are the best times to build your retirement savings and your retirement investments. A few ways to do this:

- Meet with a Financial Advisor near you. We'll talk through your goals, timeline and priorities.

- Open an IRA (Traditional or Roth). These accounts allow you to make tax-deferred contributions (Roth IRA can be tax-free if specific conditions are met) until you start accessing the funds during your retirement. IRAs offer flexibility, and can easily be combined with additional retirement savings options that you may have through an employer including 401(k) options. Click here for 401(k) frequently asked questions.

- Find additional money each month to put in your retirement savings. Evaluate your budget and find even $5 to save each month. It adds up.

As you approach retirement in your 50s or 60s, how confident are you in meeting your retirement planning goals? You need the right Financial Advisor to help you understand if you're on track to meet your retirement goals.

When you've reached retirement age, the work days have stopped but all of your hard work keeps paying off. Together we can best leverage your retirement income, making the most of your retirement financial planning that you've focused on throughout your career.

Investment and insurance products and services are offered through INFINEX INVESTMENTS, INC. Member FINRA/SIPC.

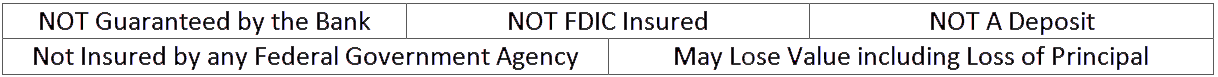

Infinex and Nation Choice Reserve Bank are not affiliated. Products and services made available through Infinex are not insured by the FDIC or any other agency of the United States and are not deposits or obligations of nor guaranteed or insured by any bank or bank affiliate. These products are subject to investment risk, including the possible loss of value.