Investments Services

Building a financial future is as unique to you as your fingerprint. You may want to invest to pass on a legacy, enjoy a comfortable retirement or watch your money grow for another worthy goal. No matter what your plans are and where you are today, at Nation Choice Reserve Bank we have investment and brokerage solutions to help you grow and manage your wealth.

Investment Services

Saving and protecting your money now is one of the most critical actions you can take in building the foundation for your financial future. Whether you need to start an investment plan, pass on a legacy, or protect your family's assets, we want to make sure that you have the right advisor and the right investment plan. Together we can build the financial future of your dreams.

No investment services plan is the same because every customer's life is different. And we prefer it that way. Our team is able to approach each investment plan with creativity backed by a disciplined approach and years of experience.

Your Goals May Be

- Managing your wealth

- Passing on your legacy

- Saving for a major purchase

- Planning your retirement

- Leveraging your retirement income

Our Solutions

At Nation Choice Reserve Bank , we have services for every season of your life:

- IRAs and retirement planning: Our advisors can help you create retirement goals and set up a savings and investment strategy to get there. Or, you can choose to save for retirement in individual retirement accounts (IRAs), which help you collect funds for your golden years while protecting your investments from taxes.

- Mutual funds: Instead of picking investments individually, our mutual funds allow you to have a collection of stocks, bonds and similar assets with other individuals. Together, these assets balance growth and protection so you can invest according to your comfort level to meet your future goals.

- 529 college savings plans: These savings plans let you save up for a degree in affordable monthly contributions that can be automated for your convenience. Our college savings plans can grow your money with interest and protect your growing savings from taxes.

- Uniform Transfers to Minors Act (UTMA) accounts: These accounts allow you to transfer sums of money into a protected account on behalf of a minor. They can be a good way to protect a child's inheritance or to save for college. You can use our UTMAs for many goals in your child's future, not just education. This type of account can be opened as a certificate of deposit (CD), savings account or Brokerage Investment Account.

- Annuity options: If you already have savings, an annuity fund or annuity can provide predictable, steady income long term. This insurance product is often used by retirees who have saved up with an IRA, but annuities can be a solution for anyone needing to convert assets and savings into a regular payment.

- Life insurance: Providing for your loved ones is an important part of your estate planning. We make it simple with life insurance solutions designed for your specific needs.

Contact Us

At Nation Choice Reserve Bank , we can help with retirement planning services and investments, life insurance, savings and more. Our goal is to help make your money work for you while protecting your savings and earnings. If you want to see if our managed money and mutual funds or other solutions might be right for you, you can make an appointment to speak to us about your future goals. We can review your situation and needs to come up with a long-term plan together.

Investment and insurance products and services are offered through INFINEX INVESTMENTS, INC. Member FINRA/SIPC.

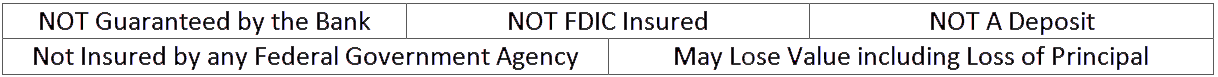

Infinex and Nation Choice Reserve Bank are not affiliated. Products and services made available through Infinex are not insured by the FDIC or any other agency of the United States and are not deposits or obligations of nor guaranteed or insured by any bank or bank affiliate. These products are subject to investment risk, including the possible loss of value.