Our Best Annuity Options & Rates

An annuity or annuity fund is an insurance product that can provide long-term income, often used to help fund retirement. Choosing the best annuity for retirement is a personal experience depending on your goals and the additional accounts you are leveraging to fund your retirement. Before choosing an annuity, ask questions and use our annuity selection guide to you ensure you're getting the best annuity for retirement. Our Financial Advisors are happy to help in your selection.

Types of Annuities

There are many types of annuities but the most common are fixed, variable and indexed.

- With a fixed annuity, the amount you will receive every month (or year, depending on the schedule) is fixed and will not change.

- With a variable annuity, your returns are based on market performance and how your investments were allocated.

- An indexed annuity

Annuity Benefits

- Annuities can provide fixed income payments for life.

- Your money can grow tax-deferred

- Timed payments minimize tax implications

- Annuities are an additional way to fund your retirement once you've maxed out contributions to a 401(k) or IRA

We offer access to annuities from many of the largest insurers in the world. Choosing the type of annuity that is right for you depends on your goals. Your Financial Advisor can help you decide if an annuity is right for you and help you select the one.

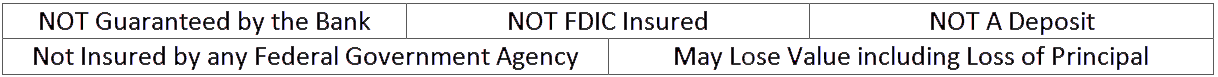

Investment and insurance products and services are offered through INFINEX INVESTMENTS, INC. Member FINRA/SIPC.

Infinex and Nation Choice Reserve Bank are not affiliated. Products and services made available through Infinex are not insured by the FDIC or any other agency of the United States and are not deposits or obligations of nor guaranteed or insured by any bank or bank affiliate. These products are subject to investment risk, including the possible loss of value.