401(k) Plan Frequently Asked Questions

Nation Choice Reserve Advisors has answers to commonly asked 401(k) questions. Read them below, and learn how our wealth management services can give you customized guidance and planning.

1. Why should I make a 401(k) investment?

Here are some of the top reasons:

- It's painless. You simply sign up and your employer deducts and deposits your contributions into your plan account.

- Your money grows and compounds tax-deferred. This simply means your contributions are deducted before federal income taxes are withheld, and as your deposits grow and earn income you do not pay any taxes on the gains and/or dividends and interest. The tax is deferred until you take the money out at retirement.

- Interest compounds - your dividends, interest, and capital gains are reinvested into your plan so you earn interest on your original deposits and their earnings. This helps your account grow faster.

- You can contribute more to a 401(k) plan than you can to an IRA. Your plan may have a set limit or percent that you may contribute, you should check your SPD.

- Dollar-cost averaging allows you to buy low and sell high. As you save over a period of time you will buy some of your assets at higher prices which means you will buy fewer shares, and you will buy some of your assets at lower prices which means you will buy more shares. This tends to lower your average cost per share.

- It's an inexpensive way to create a diversified portfolio of professionally managed assets. Choosing the appropriate investments can be a daunting task. Even though your employer chooses the mix for the Plan, you will still have to do your homework to make the correct selections for your own personal mix. You also don't need to make any minimum deposits into the Plan's mutual funds as you would be required to in other investment accounts.

- You can take your account with you when you change jobs, you can rollover your account into you new employers 401(k) or into an IRA without tax consequences.

- Social security won't provide for all of your financial needs in retirement. You'll need at least 60% to 80% of your pre-retirement compensation to meet your financial obligations and live comfortably in retirement. This is where investing in your 401(k) Plan can make retirement a little easier.

2. If I decide to participate in my company's 401(k), when would I be eligible?

Eligibility requirements are different for each 401(k) plan. Some plans allow participation immediately while other plans require certain service and/or age minimums. You should refer to the Summary Plan Description (SPD) of your plan that was provided in your enrollment materials.

3. How much can I contribute to my 401(k) plan from my compensation?

Your 401(k) plan may have set limits on the amount you can contribute from your compensation. To understand those limits, you should refer to your SPD from your enrollment materials.

4. If I choose to participate in my company's 401(k) plan and later change my mind, may I stop contributing to my 401(k) at any time?

You may stop making contributions to the plan. Just notify your Human Resources representative for the appropriate forms. The money you have already contributed to the plan must stay in the plan until you satisfy one of the conditions that would allow you to take a distribution from your plan.

5. How are my plan contributions invested?

You can select the investment or investments that best help you meet your personal retirement goals. You may change your investment elections as often as you wish but you should make your choices for the long term. You may also transfer money among these choices. You should refer to your enrollment materials for the list of fund choices available in your plan.

6. Will my employer contribute money to my 401(k) plan?

It depends. Some employers may match a portion of the amount you contribute from your paycheck. Some employers may deposit other types of discretionary contributions such as profit sharing contributions. Your SPD will explain the specific contributions your employer may make to your plan.

7. When can I withdraw from my 401(k) plan?

The money you contribute to the plan is intended to provide for your retirement. Your money can be withdrawn when you retire, terminate employment or become permanently disabled. You may be able to withdraw your money under other circumstances outlined in the Summary Plan Description that you would have received at the time you were eligible to enroll in the plan. You should refer to this document or check with your plan administrator if you have questions about this feature.

8. If I leave my job, do I lose the money I put in the plan?

The contributions you put in the plan along with any earnings are owned by you. If your employment ends for any reason, the money is yours to take with you. The contributions made by your employer may be subject to a vesting schedule. You should check your Summary Plan Description you received when you enrolled in the plan to determine the vesting schedule.

9. What is 401(k) vesting?

Vesting refers to the ownership you have in certain monies that are deposited to your retirement plan. When you contribute salary deferrals to your 401(k), the money is always 100% vested at the time the contribution is made. Employer money may be subject to a vesting schedule. In order to accrue a vesting year, you might have to work a certain number of hours within a specified period or meet certain requirements. For example:

- An employer is making a matching contribution for participants who are deferring and has established a 2/20 vesting schedule.

- The plan has a service requirement of 1,000 hours in a 12-month period before joining the plan (from hire date to anniversary date).

- Every year you work at least 1,000 hours you would get a percentage ownership in the employer's matching contribution.

|

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

Year 6 |

|

|

Vesting % |

0% |

20% |

40% |

60% |

80% |

100% |

10. What are 401(k) tax rules?

Under the current federal tax law, the amounts you withdraw from your 401(k) will be taxed to you as ordinary income. If your plan allows after tax contributions these monies will be returned to you free of any tax consequence. If you withdraw $10,000 of deferrals and earnings from your 401(k) in a certain year, you must generally include that amount in your income for tax purposes. Keep in mind any distributions that are made prior to attaining age 59 1/2 or before a death or disability are subject to a 10% early withdrawal penalty tax, as well as regular income tax.

You may be able to avoid immediate tax consequences by transferring your eligible distribution to an Individual Retirement Account or to a new employer's tax-qualified retirement plan. This way you will not owe any taxes until you take a withdrawal from the rollover IRA or the new plan. After-tax contributions can roll over into a Roth IRA. In any case you should consult your tax advisor concerning your particular tax situation.

11. If my employer declares bankruptcy, could I lose my retirement plan money in your 401(k)?

If your employer declares bankruptcy, all of your contributions that have been deposited to your account prior to the filing are protected. All vested employer contributions are also protected. If your employer lays off a large number of employees within a year, your unvested employer contributions may become fully vested.

12. Can my employer commingle employee deferrals with the employer's business accounts?

The Department of Labor has made significant modifications to the Form 5500 and inquires as to whether the employer has deposited the employee's elective deferrals within the regulatory period. If the employer has not made these deposits in a timely manner, the late deposits are reported on the Form 5500 and the employer is assessed a penalty.

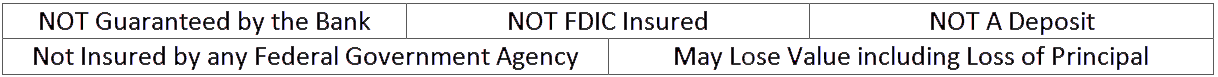

Investment and insurance products and services are offered through INFINEX INVESTMENTS, INC. Member FINRA/SIPC.

Infinex and Nation Choice Reserve Bank are not affiliated. Products and services made available through Infinex are not insured by the FDIC or any other agency of the United States and are not deposits or obligations of nor guaranteed or insured by any bank or bank affiliate. These products are subject to investment risk, including the possible loss of value.